Signature checking-This is an interest checking account with additional benefits. Depending on the balance, the annual percentage yield usually ranges from between 0.01% and 0.03%. A 30% monthly service fee applies on this checking account.

Bank of the West offers a variety of financial services; including checking and savings accounts, credit cards, auto, home and personal loans. Visit us online or at any of our more than 500 branch locations. The bank is always after new and better ways of enhance your banking experience. Online banking from Bank of the West allows you to bank while at home, in the office or on the go through your mobile device. Online banking is easy, secure, convenient and available 24/7.

The guide below will highlight the steps followed when Bank of the West customers want to login, enroll and recover their online banking login credentials. Easy checking-This is a basic account with a very low minimum balance. It does not have an annual percentage yield and a monthly service charge of between $8 and $10.

Account holders can also access online and mobile banking with a debit card, Bill pay and overdraft protection included. Bank of the West has made it a lot easy for customers to access their bank accounts from anywhere, anytime. All they need to do is register for the internet banking services offered by the bank. With this step by step guide, you will be able to login, reset your password and register for the internet banking services easily. Bank of the West is a regional financial services company.

Bank of the West offers deposit accounts, credit cards, insurance, investment products, trust services, and financial planning. It mainly originates commercial, small business, and consumer loans and leases. Just be mindful of the transaction limits, which trend conservative compared with other business checking accounts.

Any Deposit Checking for Business includes just 50 free transactions per month. You might be better served at another bank if your business needs more than that. Beginning very soon, we are making a change to your online banking login process. In order to increase security and provide robust protection from fraudsters, we are implementing a new authentication process to your online banking login.

Beyond that, Bank of the West's business accounts don't have a lot of bells and whistles. But the base checking account, Any Deposit Checking for Business, will get the job done for no monthly fee, provided you make at least one deposit per month. It offers online bill payment facility to all its users and provides several different methods to pay bills. You can pay your bill online at Bank Of The West's website, mail your payment to the processing center, or pay your bill in person at any authorized location. It also provides you with the option to set up automatic bill payments online and make alternative payment arrangements. You can also cancel account and contact customer support online.

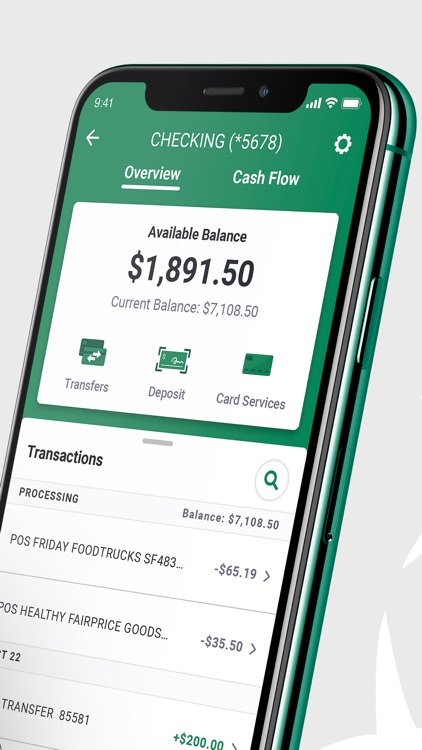

Bill Pay is now available for consumer online banking users through our website or our convenient mobile app. If you are interested in signing up for Bill Pay, please contact your local Branch office for more information. Convenient banking features are right where you expect them to be. Simple, tabbed navigation, online bill pay, customizable financial tools and more. Enjoy convenient access to the online banking features you need most.

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty.

When evaluating offers, please review the financial institution's Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. No need to panic if your balance briefly dips into the red. Bank of the West business checking accounts include a $5 overdraft buffer.

Beyond that amount, you're hit with a $35 overdraft fee for each item paid or returned. Step 1 - Kindly open bank's website on your web browser. Step - 2 Please enter Login ID and Password under Personal tab then click Go. The bank online system will validate your credentials and redirect you to your online banking account.

By clicking 'Continue', you will leave our website and enter a site specific to making your loan payment via a debit card or electronic check. This icon indicates a link to third-party content. By clicking on the link, you will leave our website and enter a site not owned by the bank. The site you will enter may be less secure and may have a privacy statement that differs from the bank. The products and services offered on this third-party website are not provided or guaranteed by the bank. Checking Accounts Choose the checking account that fits your lifestyle.

You'll get 24/7 access to your funds and online tools to help manage your money. Owning a business is challenging, but there are ways to make business banking easier, especially online. We have helpful cash management and remote deposit tools, as well as information on cybersecurity and commercial lending.

There are many benefits that come with an opening an account with Bank of the West. Despite being a brick and motor bank, they have also embraced technology and are now offering online banking services to customers who have an account with them. In this post, we will be looking at some of these benefits in depth. Whether you're using the mobile Web or a mobile app, don't let your device automatically log you in or remain connected to financial or sensitive apps or websites. Otherwise, if your phone is lost or stolen, someone will have easier access to your information. Our mobile devices are convenient and are a big part of how we keep in touch with the world.

It makes sense that we now have banking information at our finger tips, 24/7. By now, mobile banking is a pretty common term that most of us hear on a day to day basis. In today's world nothing can be 100% secure from some type of compromise, but the banking industry has taken major steps to make sure that mobile banking apps are secure. The problem often lies with the mobile device and how it connects to internet. This change will first occur through the web login on this page, and will soon be followed with changes to our mobile app.

We believe that this new process will help us better protect your account information by adding another level of protection against unauthorized access. For errors involving new accounts, point-of-sale, or foreign-initiated transactions, we may take up to 90 days to investigate your complaint or question. For new accounts, we may take up to 20 business days to provisionally credit your account for the amount you think is in error. We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not provisionally credit your account.

Now offering convenient online personal checking and savings account opening. Free transactions are limited to either 50, 150 or 500 transactions per month, depending on the account. Transactions include all withdrawals, transfers, debit card purchases, paid checks and deposited items. Low transaction allowance for the bank's entry-level and mid-tier business checking accounts. Mountain West Bank's online banking is one of the easiest and most convenient ways to do your banking.

It's safe, secure and there is no special software to buy or install. You can access your online banking information 24 hours a day; anywhere you have access to the Internet. Bring PWB with you wherever you go with our business mobile banking.

Easy access through your phone keeps banking easy and doesn't slow you down. Bank of the west offers a safe and secure access to your account thus allowing the opportunity to manage your finances from anywhere. The service is available to all customers registered online. After submitting the details, the internet banking facility will be activated by the bank. The customers can log in to the internet banking account. Consequently, here is useful information to help you log in to their Online Banking page.

Sign in to Online Banking from Bank of the West to easily access your account information, transfer funds between accounts, pay bills and more. Did you know that you can view your account statements online? You can view up to the past 18 months of account statements from within online banking by clicking the "Documents" tab while viewing any account. If you would like to "go paperless" and receive your statements only by electronic means, you can do that too! If you'd like more information regarding eStatements, please contact your local branch office of The Bank of The West.

Don't save your password, account number, PIN, answers to secret questions or other such information in an unprotected manner on the mobile device. Consider using a secure password keeper app for this purpose. West Valley National Bank was formed by a group of local residents from the West Valley area of Phoenix, Arizona. They strategically discussed the lack of quality financial services available to the small businesses in the West Valley. In a world of online banking, fraud and scams can happen at any time.

Learn how to protect yourself from fraudulent scammers using our helpful information. We provide foreign exchange solutions to businesses for international payments, risk management, and cash management. Transfer funds from person to person, account to account, anywhere in the U.S. or the world, with our easy and secure service. Our services are an ideal way to transfer funds to anyone in the world. One of the main downsides of having an account with Bank of the West, whether it's a checking or savings account, require a monthly service fee. Although these service fees can be waived, users are required to meet certain requirements.

If the requirements are not met, then the charge will certainly apply. Bank of the West has been managing its customer's money for more than 135 years. For individual, commercial and small business clients, the bank provides banking solutions as well as investment and lending opportunities. A wealth management solution is also available for more affluent clients.

You can login to Bank Of The West online account by visiting this link and access all the features. Launch your Web browser and navigate to Bank Of The West's Login page . • Access up to 7 years' worth of checking, savings, CD and credit card account statements online.

Be the master of your money with the Bank of the West app. Enjoy secure access to your accounts and manage your finances from virtually anywhere. Our commercial bankers are dedicated to finding creative solutions that match your individual situation. Your business is unique and so is our approach to being your bank. We offer local commercial lending decisions with flexible options.

Like your business, we are part of the community. That means we will work to make our relationship successful. Plus, you can choose from multiple account features and profile updates for whatever your specific needs.

You can order checks, request a stop payment on a check and set up recurring direct deposits. And if you want to change your username and password, it's simple, safe and convenient. You have the ability to remotely deposit checks directly into your account with this convenient and secure solution. Control your spending and protect yourself against fraud, all through a simple, easy-to-use app on your mobile device. Bank of the West's Any Deposit Checking for Business technically isn't free — the account carries a $10 monthly service fee.

But that fee is waived as long as you make one deposit per month. That's a low bar to clear, even for businesses on a shoestring budget. Won't exceed 50 banking transactions per month or are willing to pay a monthly fee for a higher allowance.

Online & Mobile Banking Transfer funds, pay bills, deposit checks, track your spending, and more, all from the palm of your hand with the Central Bank app. West Union Bank is independently owned and operated by local West Virginians, and provides the same stability offered by larger financial institutions. As a member of TopNet, a cooperative group of noncompeting, locally owned community banks, we work with our peers to ensure a brighter financial future.

Our staff also undergoes continuing financial education to be the best that we can be. Whether you're starting or growing a business, we have a checking account to help you manage your everyday operations. For a limited time, open a Standard Business Checking account and we'll waive the monthly fees for six months. Operating a business requires a steady flow of capital. Our loans and lines of credit are tailored to provide the funds you need to run and expand your business. Keep your finances simple, organized, and secure with our customizable businessBridge® Premier online banking platform and eStatement service.